Better Than a Lease? A Balloon Loan Primer

Why Consider A Balloon Loan…

A balloon loan combines features of a lease, such as low payments based on a residual value, with features of a loan, such as direct ownership. This type of financing is now gaining popularity with captive lenders, who may call them “Select” or “Option” programs, and offer them alongside more traditional lease and conventional financing options. However, these programs terms are generally favorable to the lienholder, and while the concept is valid, better programs can be found in the open market.

Here we focus on the concept of a non-captive or indirect balloon loan, most commonly funded by a credit union. The flexibility of these third-party programs are generally applied one of two ways. The first approach combines a short term with a large down payment, so the loan balance is very close to the RV. The resulting payments are small, as only the debt service is being paid. The second approach combines a long term with no down payment. The resulting payments are small, as the balance due is spread over the long repayment period.

Other benefits of a balloon loan include the ability to recover positive equity at the end of the payment term, which is especially important in today’s market where vehicles regularly outperform residual value. A balloon loan is considered a cash purchase, so it captures manufacturer rebates which may only be available to such a purchase. In many states, you can transfer plates and registration, which can result in a nice savings.

Combining one of recommended approaches with some or all of the additional benefits can result in a very competitive total cost of ownership, even when compared to the lowest rate long term conventional financing available. In the end, for those who are looking to maximize monthly cash flow, above all else, a non-captive balloon loan can be a good option.

What Is the Downside of Using a Balloon Loan…

Yes, a balloon loan carries risk. That risk results from the sum of the payments not bringing the loan balance to zero and a final balloon payment due to cover the difference. The borrower must therefore execute on the most beneficial disposition option; buy, sell or refinance. As compared to a lease, where you can return the vehicle, or with a loan, where you will own the vehicle free and clear, a balloon loan can leave you upside down.

Other downsides of a balloon loan include, in most states, you will need to pay full sales tax upfront, so no tax advantages, like a lease. Balloon loans generally do not residualize options very well. The best build for most vehicle is a base trim level. The interest rate is usually one point higher versus conventional financing. For high end vehicles over $70K, there can be an additional origination fee.

Another Consideration… Return your vehicle like a lease.

A rider to a balloon loan can be included to create a vehicle return option. Including this rider increases the loan complexity, and for the general/original purposes of this article, we are excluding the consideration of this optional rider. However, as the market has changed over time, the vehicle return rider does provide a useful method to insulate oneself from potential significant depreciation. When using this rider it essentially turns a balloon loan into a lease, so the balloon program would need to have a superior RV and/or interest rate, as compared to captive leasing program, to make sense. Examples of this return rider can be found in this thread body.

The Right Conditions for a Balloon Loan…

Once you have decided that the risk and rewards of a balloon align with your personal financial strategy, the next step is to assess if your target vehicle is a good candidate. Not every vehicle will have a competitive program, so some research will be necessary to compare payments and total cost of ownerships across financing options. Generally, cases where a balloon loan program work well:

- Short term ownership is desired. Balloon loans are NOT for vehicles you will hold forever.

- Where a vehicle hold resale value very well, and can return positive equity at term end.

- Where one finds a favorable program MRM/RV for a vehicle from a lender.

- Where a long term, low rate, conventional loan cannot be used.

Where can I get a balloon loan…

The most common institutional lender offering balloon loan programs is Auto Financial Group (AFG), and they do not offer the program direct to the public. Instead, the program is offered via affiliated credit unions. Thus, most credit unions who advertises a balloon loan offering are reselling the same AFG program. Some credit unions may call these programs something like “better then a lease” or “payment saver” and may charge different rates and/or fees – but they are all fundamentally the same The below list provides suggested credit union offering this program.

- AmeriCU Credit Union (https://americu.org/ 249) Paysaver auto loan product offered at low rates and across various terms. A one-time donation to the American Consumer Council permits membership. You can join and apply online, but I recommend pro-actively calling a branch and working directly with a loan officer. Uses experian for credit checks. Can take longer to close.

- CapEd Credit Union (https://capedcu.com/ 173) Payment saver auto loan product offered at moderate rates and across various terms. A one-time donation to the CapEd Foundation permits membership. You can join and apply online, you will be assigned a loan officer who will follow-up over the phone. Uses transunion credit checks. Can close quickly.

- Hanscom Federal Credit Union (https://hfcu.org/ 183) Better then a lease auto loan product offered at higher rates and few terms. A one-time donation to the Nashua River Watershed Association permit membership. You can join and apply online, you will be assigned a loan offer who will follow-up over the phoner. Uses transunion credit for score. Can close quickly.

Another institutional vendor, CULA 20, is also gaining popularity as another option for indirect leasing through partner credit unions. However, it appears that these programs are only accessible to dealers and not the general public. These means to access these programs you must use a dealer from the network.

How Do I Use A Balloon Loan Calculator…

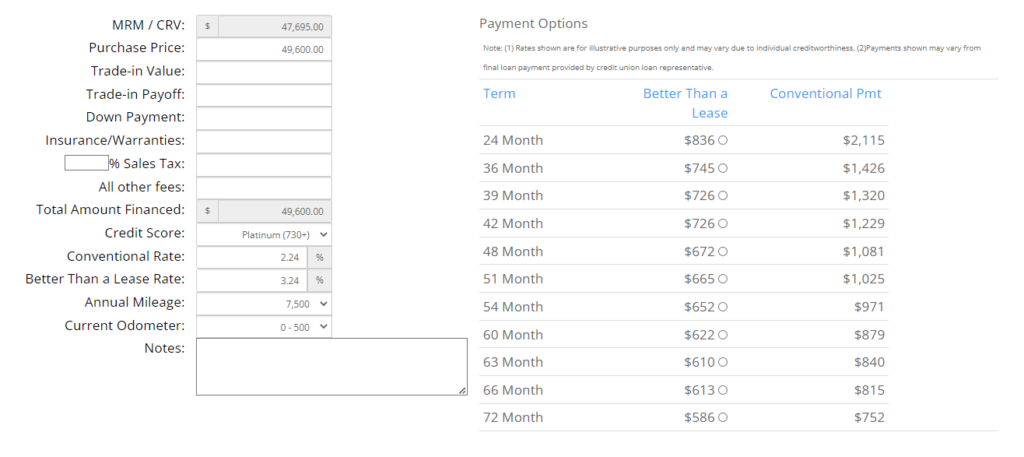

- AFG Default Payment Calculator AmeriCu Calculator 353 Use this calculator first, to determine the loan balance, rate and payment for your preferred term. Here is what a calculator looks like setup for a Ford Mach-E purchase in NJ. Note that the lowest mileage option has been selected, since we will not be returning the vehicle.

- Balloon Loan Reverse Calculator Balloon Payment Loan Calculator |- MyCalculators.com 248 Use this calculator second, take the data from the previous calculator and solve for the final balloon payment. Given the 24mo payment from the AFG calculator, we can solve for the final balloon payment…

Acronym’s & Terminology used in this wiki

MRM / CRV – This is the value of the vehicle assigned by AFG. It is based on the “Maximum Residualized MSRP”, which consists of the MSRP of the typically equipped vehicle and value adding options giving only partial credit or no credit for those options that ALG understands add little or no value to the resale price of the vehicle.

Purchase Price – This is the price you can purchase the vehicle from a dealer.

Down Payment – Upfront funds used to reduce the loan balance.

Total Amount Finance – The amount of the loan

Conventional Rate – The rate commonly offered on traditional finance.

Balloon Rate – The rate offered with the balloon product.

Annual Mileage – Mileage affects the residual value of the vehicle.

Residual Value – The forecast value of the vehicle at the end of the loan term.

Balloon Payment – The final payment due at the end of the loan term.

MMR – Manheim Market Report, the wholesale value of the vehicle at a given point in time.